How to Monetize Payments: A Guide for SaaS Companies

How to Monetize Payments: A Guide for SaaS Companies

How to Monetize Payments: A Guide for SaaS Companies

How to Monetize Payments: A Guide for SaaS Companies

Apr 15, 2025

Apr 15, 2025

Apr 15, 2025

Apr 15, 2025

Payment monetization is increasingly becoming a "must" for SaaS companies, enabling you to unlock new revenue streams, boost customer retention, and stay competitive overall.

With the right infrastructure, you can transform payments from a back-end necessity into a core profit driver.

With businesses increasingly seeking seamless, all-in-one solutions, SaaS platforms that monetize payments are in the perfect position to deliver enhanced value while increasing their own bottom line.

Ready to do just that? Read on for the complete guide on how to monetize payments.

What is payment monetization?

Payment monetization refers to the process of generating revenue from the payment transactions that flow through a platform. Instead of simply facilitating payments as a pass-through, SaaS companies can add margin to transactions, charge for advanced payment features, or bundle payments into their core offerings to drive additional income.

SaaS companies that are able to monetize payments transform their platforms into indispensable business tools. When you implement payment monetization, you provide more value to users, all while creating scalable, recurring revenue streams.

Benefits of Payment Monetization

Unlock Additional Revenue Streams

Payment monetization allows SaaS companies to earn a percentage of each transaction processed through their platform. When you embed payment processing directly into the user experience, you can generate incremental revenue without needing to upsell or expand your core software offerings.

This model typically scales alongside your business' growth, which then creates a compounding effect that drives sustainable, long-term profits.

Enhance the User Experience

Integrated payment solutions simplify operations for your customers. How? It reduces the need for third-party providers and streamlines the payment process so customers have a more seamless experience. Your users would appreciate having a unified solution that handles both their software and financial transactions, which means they're more likely to stick with you over the long term.

Increase Customer Retention

When payments are embedded within your platform, customers rely more on your service for critical business operations. This deep integration makes it harder for them to switch providers, improving retention rates and reducing churn. The stickiness of embedded payments often translates to higher lifetime value (LTV) and greater customer satisfaction.

Models of Payment Monetization

Model | Description | Benefits |

Monetizing Transactions | Capture a percentage of each payment processed through your platform. This scales with customer growth. | Scalable revenue aligned with transaction volume growth. Easy to implement and track. |

Bundling Payments into Existing Plans | Include payment processing in subscription plans, offering an all-in-one pricing model. | Simplifies pricing, reduces customer decision fatigue, and ensures predictable recurring revenue. |

Charging for Advanced Payment Features | Offer premium services (e.g., faster payouts, advanced reporting) at an additional cost. | Tiered monetization unlocks new revenue while keeping basic services affordable. |

Charging for Non-Embedded Payment Providers | Apply fees or surcharges to customers using third-party or non-integrated payment providers. | Incentivizes adoption of embedded payments, increases revenue, and reinforces value by highlighting cost savings. |

Payment monetization comes in different forms. Depending on your platform and business model, you can opt for one or a combination of methods to drive additional revenue from the payments you process.

Monetizing Transactions

A per-transaction fee model allows SaaS companies to take a cut out of every transaction processed on the platform. This model aligns with customer growth—meaning as their sales volume increases, so does your revenue. Transaction fees are easy to implement and offer a clear, scalable path to payment monetization.

Bundling Payments into Existing Plans

Consider adding payment processing as part of your current subscription plans. Doing so creates a streamlined offering that reduces decision fatigue for customers. This model allows SaaS companies to bake the cost of payments into monthly or annual pricing, presenting it as an all-inclusive solution. It simplifies pricing while also creating predictable, recurring revenue for your business.

Charging for Advanced Payment Features

Offering premium payment features—e.g., faster payouts, enhanced reporting, or advanced fraud protection—creates opportunities to charge additional fees. This tiered approach lets you monetize payment functionality without impacting basic services. Customers can upgrade as their needs evolve, unlocking new revenue streams over time.

Charging Merchants for Using a Non-Embedded or Integrated Payments Provider

One way to encourage customers to adopt your embedded payment solution is by charging a higher fee or adding surcharges for those who choose external payment providers. This gives people a clear reason to choose your payment solutions over other providers. Just note that people generally don't like being forced to adopt vendors, so you'll need to be careful when implementing this approach.

Steps to Monetize Payments

Whether you're charging a per-transaction fee, using a subscription model, charging add-on services—or all of the above—the steps for how to monetize payments generally include the following.

Assess Your Platform's Payment Volume and Potential

Start by analyzing your current transaction flow to understand where and how payments are processed. Look for areas where embedded payments could simplify customer workflows. How can you provide immediate value through payment functionalities?

Take, for example, a SaaS platform that serves fitness studios. The platform handles class bookings, but the company noticed that many of its users (fitness studios) still manually invoice for personal training sessions or retail sales.

With that in mind, the SaaS company decides to embed a seamless point-of-sale system and recurring payments for memberships into its platform. Doing so not only simplifies operations for its clients but also captures a percentage of every transaction. Plus, it reduces reliance on external payment gateways and creates a new revenue stream tied directly to customer success.

Implement this same exercise in your business by conducting a payment audit across your customer journey. Identify areas where there's manual work or involve third-party payment providers, and devise solutions to simplify their experience.

Choose the Right Payment Partner

When it comes to fintech monetization, the right payment processor will make all the difference. Choose a provider that aligns with your growth goals, offers competitive rates, and provides the flexibility to scale.

You should also prioritize partners that offer seamless API integrations and customizable payment flows to ensure your solution fits nicely into your platform.

Another key feature is white-label capabilities for maintaining brand consistency.

Some of the steps you can take to find the provider include:

Research payment processors with experience in your industry

Request demos to evaluate API functionality

Look for scalable pricing models

Ensure compliance and security certifications

Check customer reviews and case studies

Assess customer support availability

Evaluate customization options for branded experiences

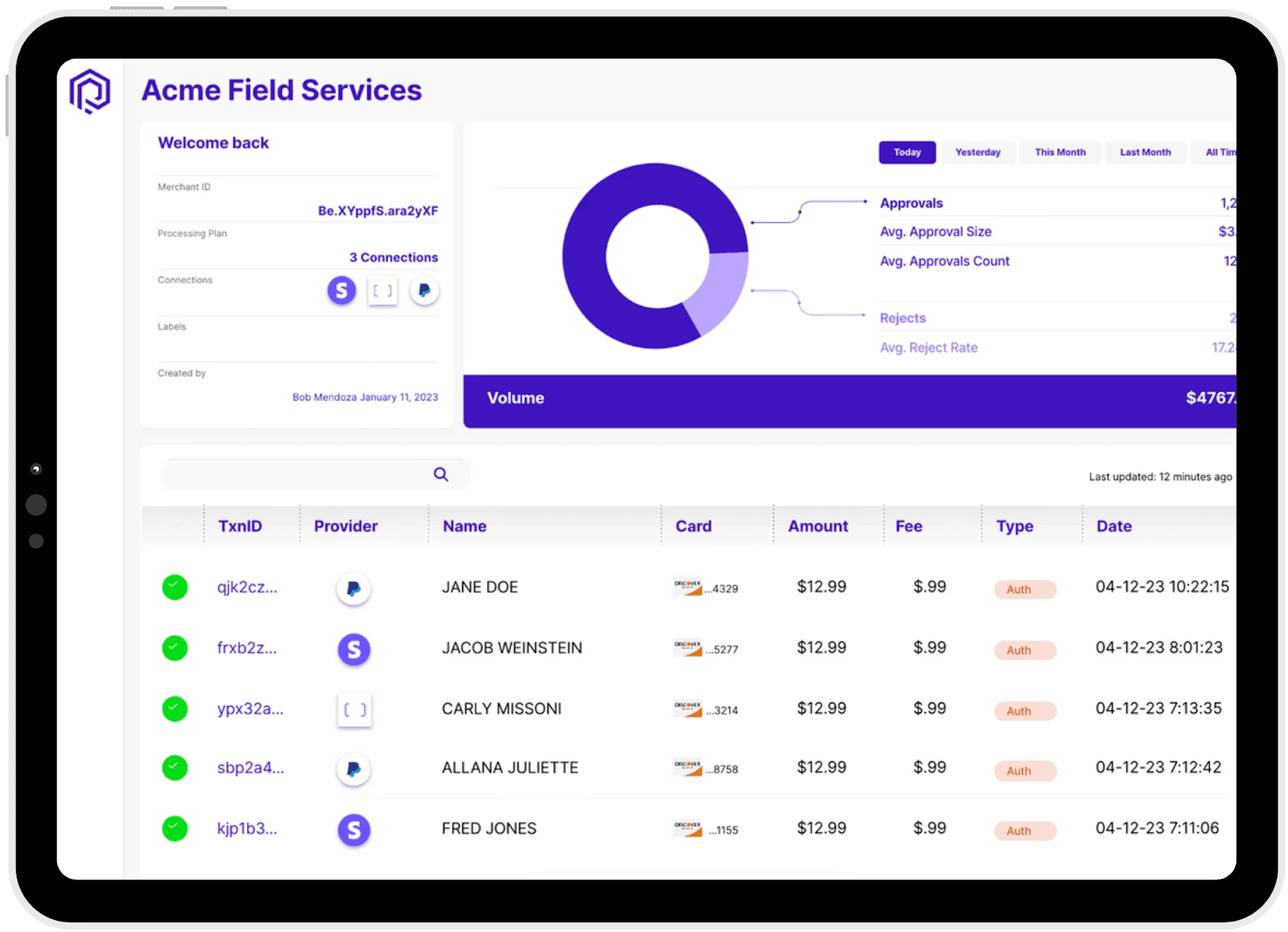

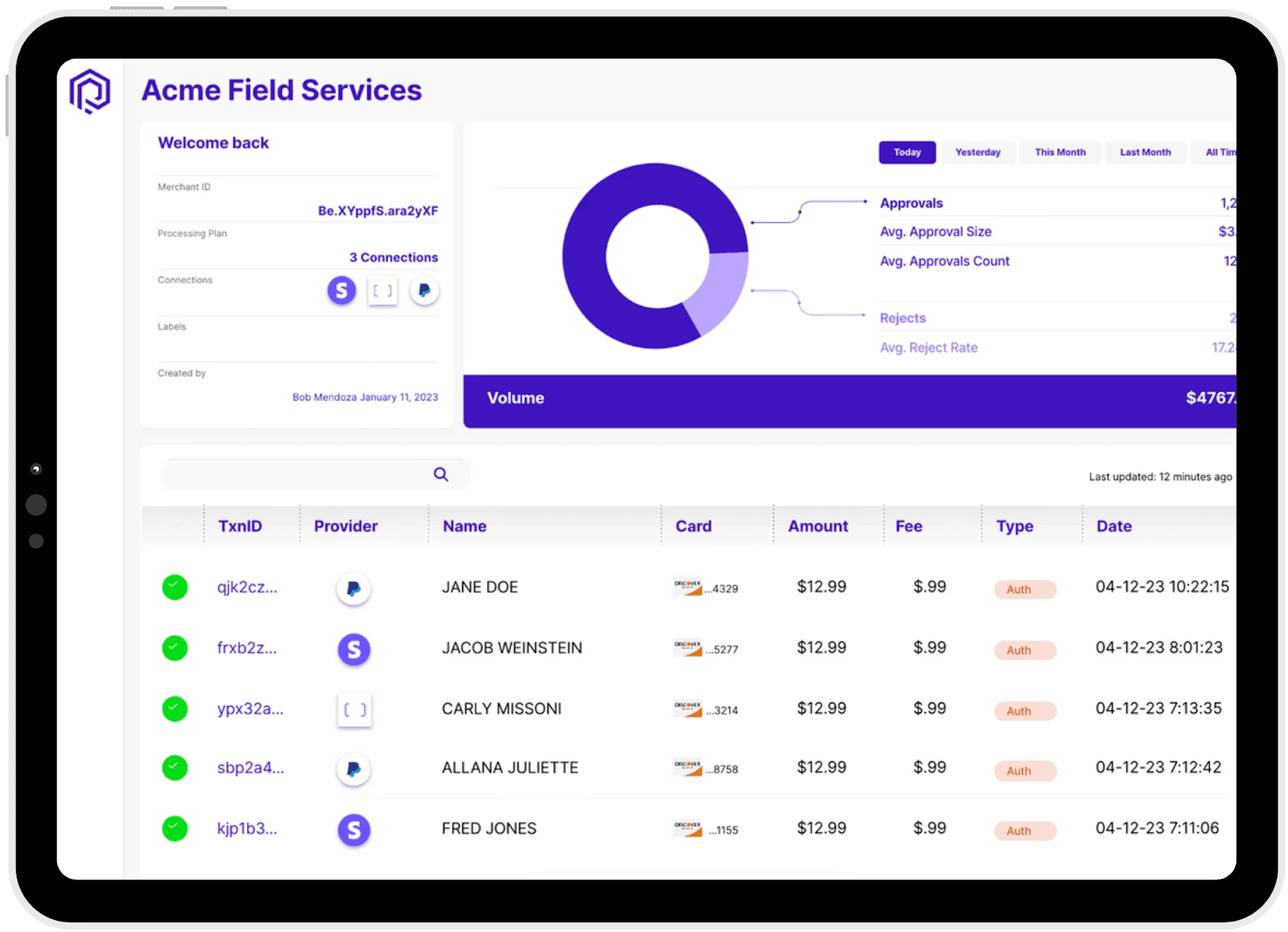

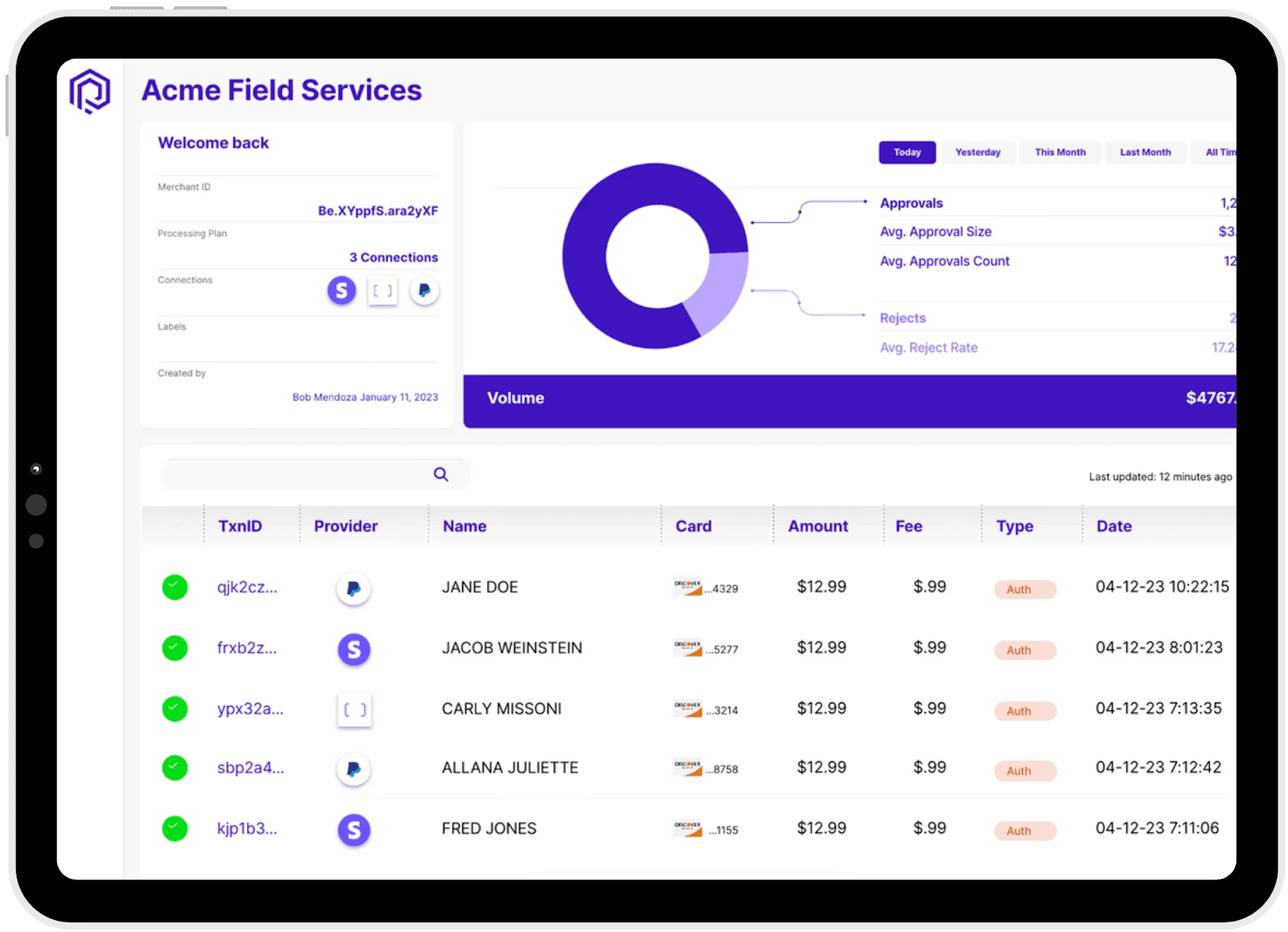

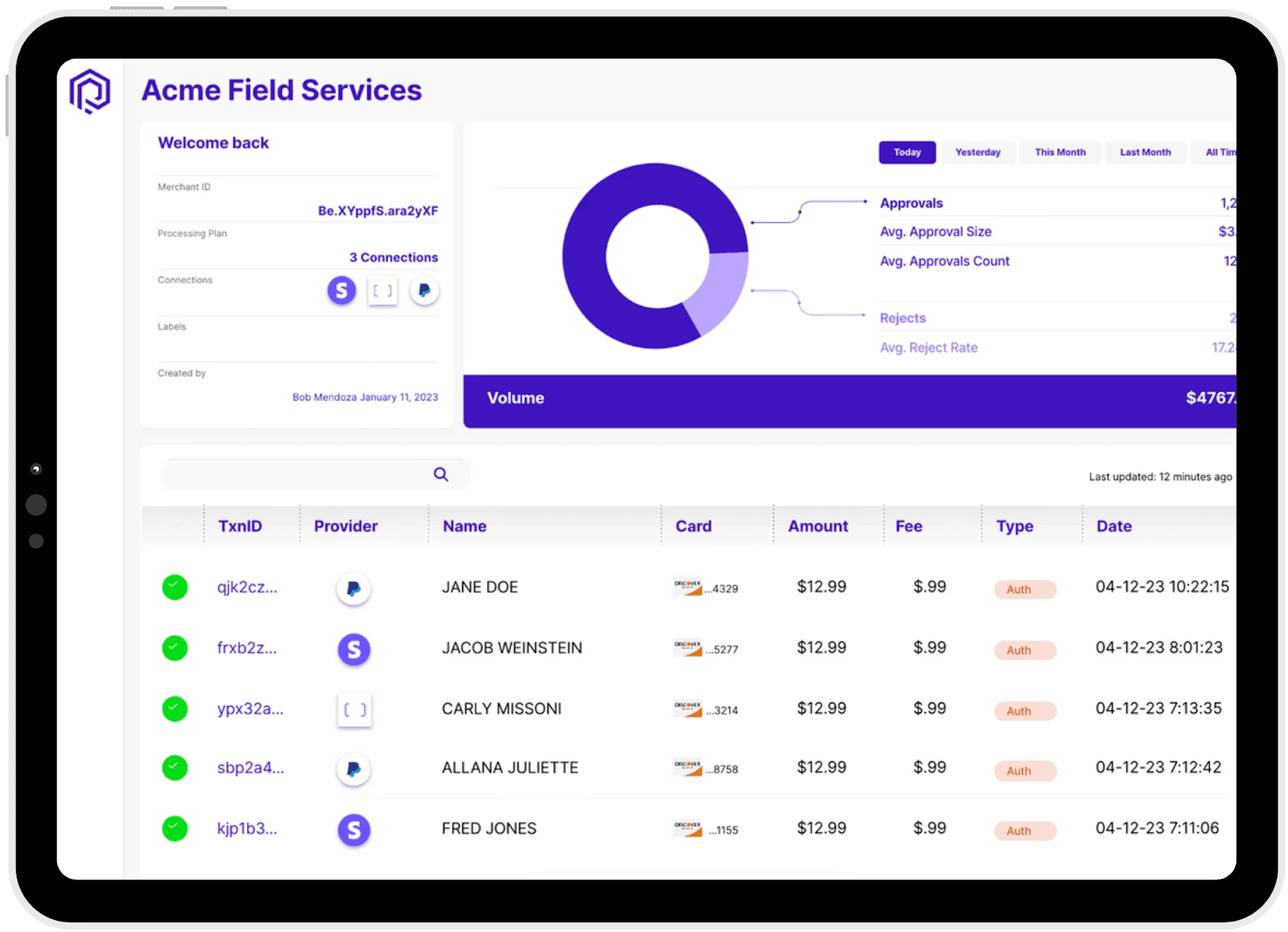

In some cases, you may need to partner with multiple payment providers or transfer merchant data from one platform to another. Preczn can help streamline the payment orchestration process by bringing together all your fintech customers, providers, services, and data.

What’s more, Preczn allows you to vault your merchants and payment data in order to prevent vendor lock-in and make payment data migration easier.

Implement Payment Enrollment

Make it easy for customers to enroll in your payment services directly through your platform. Automate onboarding processes and minimize friction by integrating payment enrollment during account setup or checkout. The faster users adopt your payment solution, the quicker you can drive revenue and increase stickiness.

Here's an example of what a good payment enrollment process can look like:

Simple opt-in during account creation

Auto-fill business details from existing data

One-click verification for account linking

Immediate confirmation emails

Guided onboarding walkthroughs

Set Up Pricing Models

The right pricing model depends on your platform and offerings. You should consider transaction fees, bundled pricing, or tiered payment features. The key is to find the right balance between revenue generation and perceived customer value.

Also, remember that transparency in pricing helps build trust and encourages adoption, so provide clear breakdowns of fees during onboarding and on pricing pages.

Build and Market Payment Features to Customers

Communicate the value of your payment solutions through targeted marketing and in-app messaging. Highlight the convenience, cost savings, and efficiency of using embedded payments.

That way, customers can easily access information about the benefits, see pricing options, and sign up or request a demo directly.

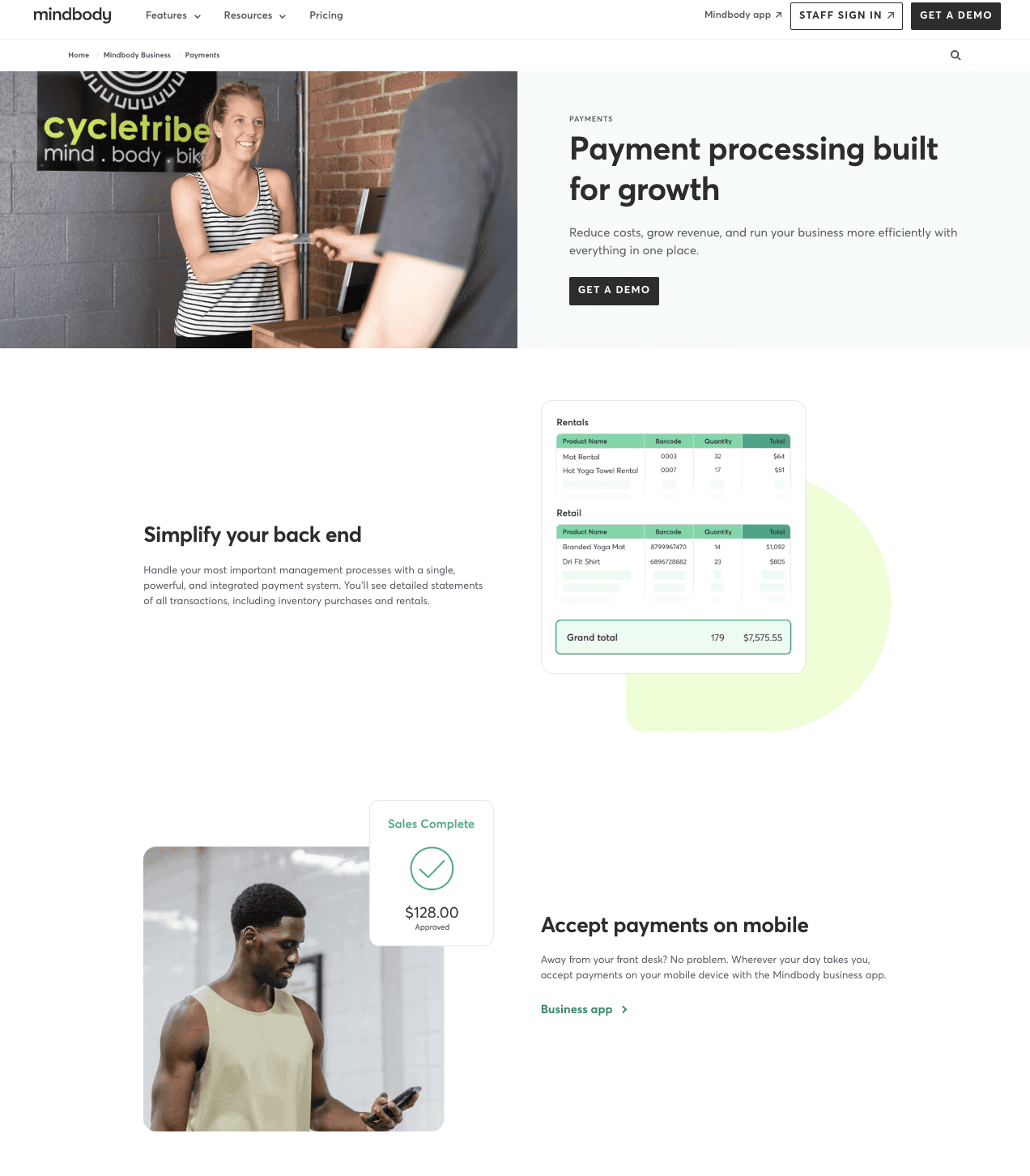

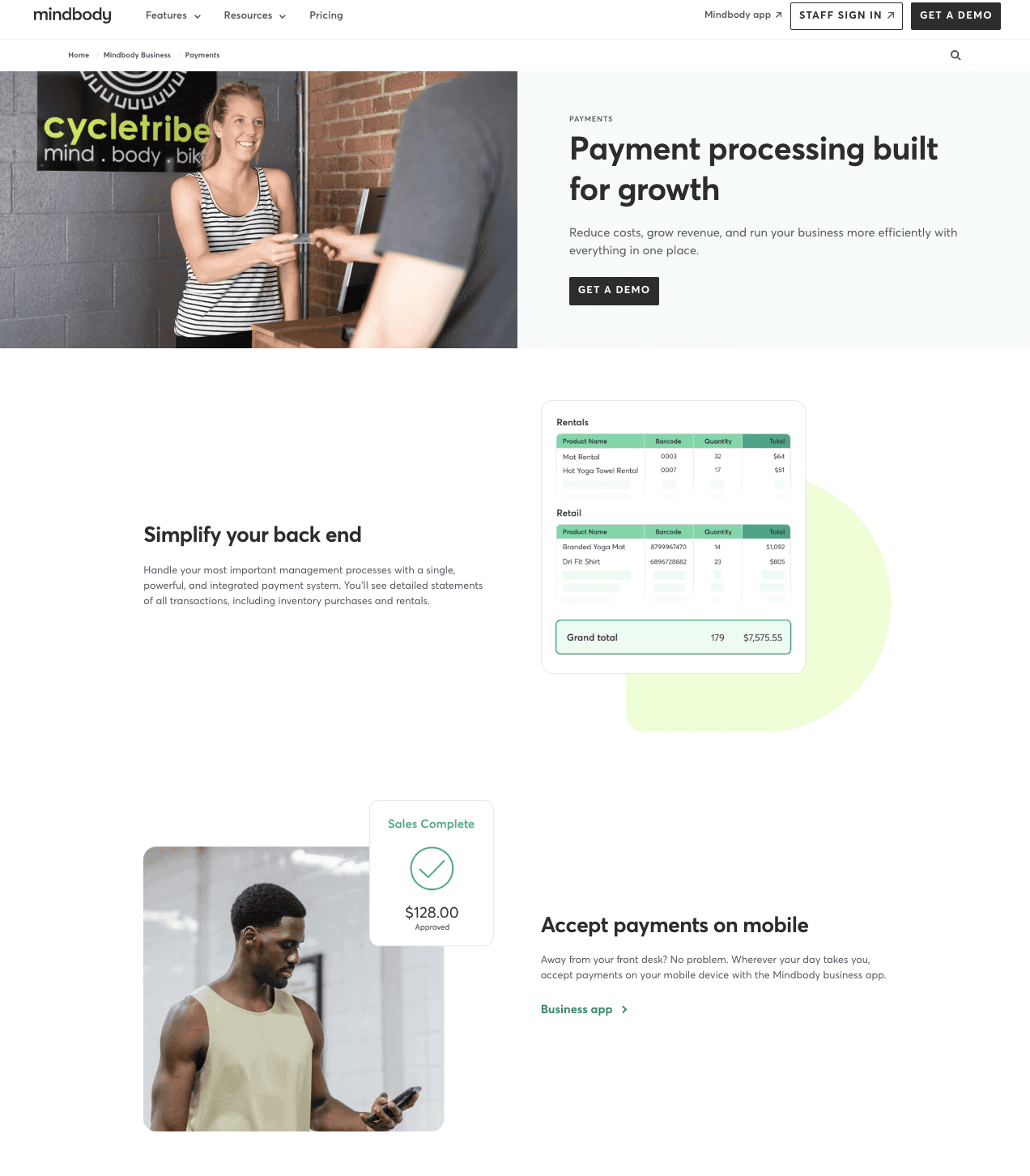

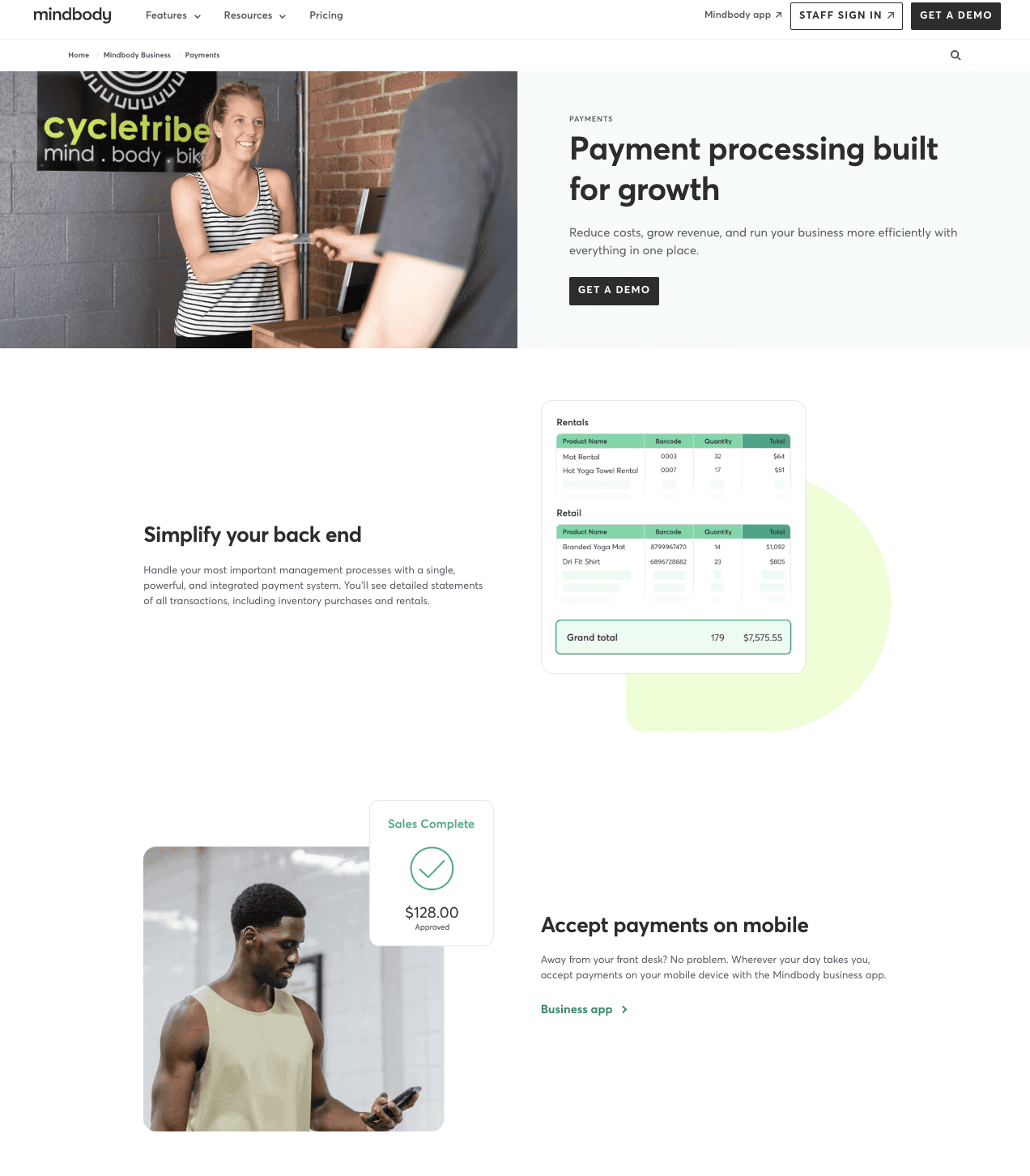

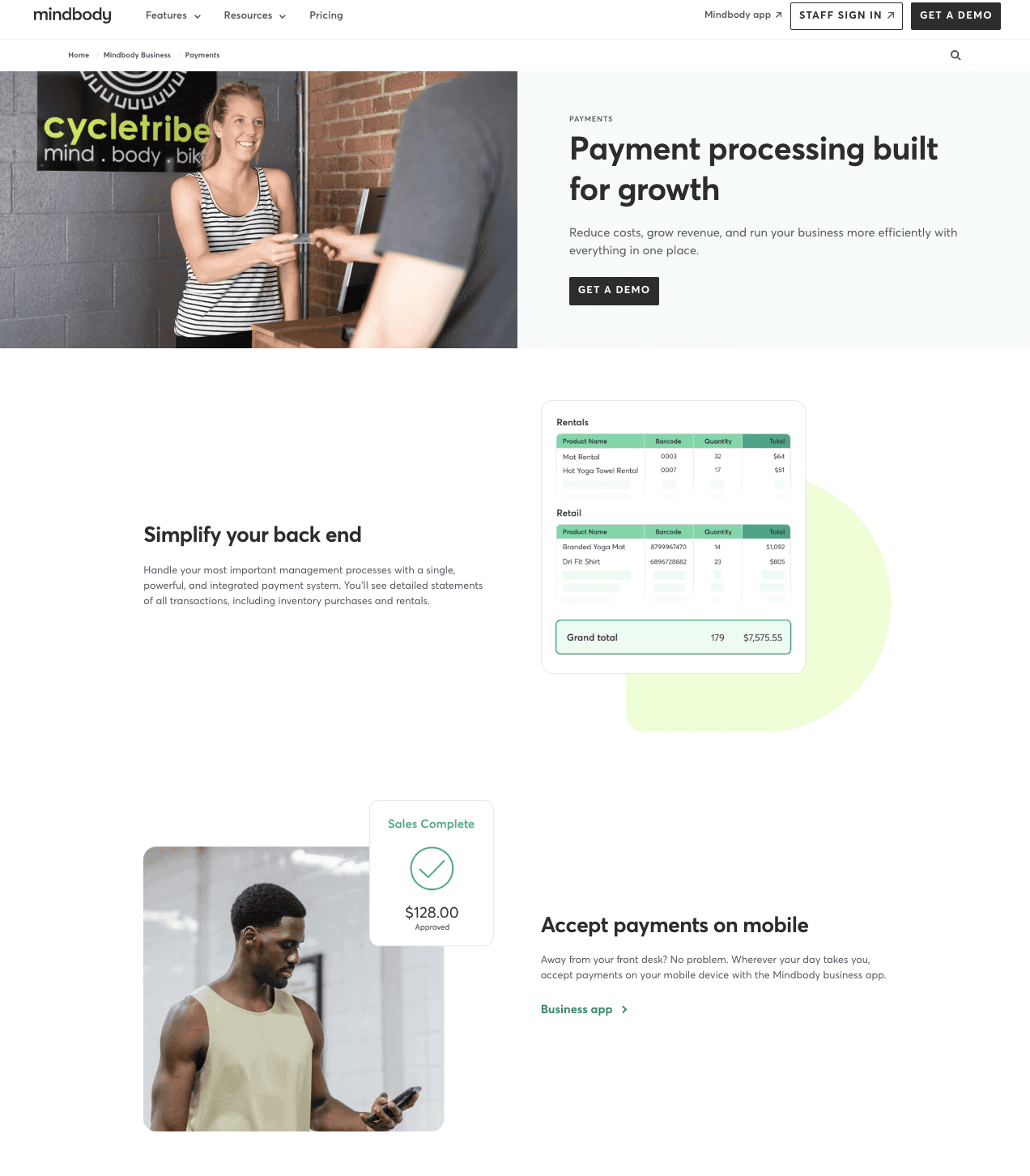

A great example of this comes from Mindbody's payments landing page. The page highlights how embedded payments reduce administrative tasks by automating billing and streamlining checkout experiences. It has a breakdown of features like point-of-sale tools and mobile payment options and emphasizes how faster transactions can improve cash flow.

Other ways to market your payment capabilities include webinars, guides, and demos to educate customers about new features and drive adoption.

Monitor and Optimize for Profitability and User Adoption

Track essential payment performance metrics. These can include:

adoption rates

transaction volumes

revenue growth.

Having these metrics in your back pocket lets you refine your payment monetization strategy over time.

Additionally, strive to optimize user experience, address pain points, and roll out feature enhancements that add value. When you do this consistently, you can sustain long-term profitability and engagement.

Key Considerations Before Monetizing Payments

Compliance and Regulatory Factors

Offering payment services comes with a lot of responsibilities. For starters, you must ensure compliance with PCI DSS standards, anti-money laundering (AML) laws, and local financial regulations. Partnering with a payment processor with built-in compliance features can help with this.

In addition, staying informed about evolving regulations helps mitigate risks and protects both your platform and your customers from potential fines or disruptions.

Technical Infrastructure and Integration Needs

Assess your platform's technical capacity to handle embedded payment flows. Seamless API integration, scalability, and data security are crucial. For best results, collaborate with your development team to ensure your platform can support real-time transactions and complex payment features. Prioritize a payment partner with robust developer documentation and support to minimize friction during integration and ensure long-term reliability.

Customer Experience

Embedded payments should enhance—not complicate—the customer experience. That's why you should create a frictionless, intuitive payment process that integrates seamlessly with your platform's existing workflows.

Also, consider additional features that can boost customer satisfaction and adoption rates. Things like flexible payment methods, one-click checkout, and transparent pricing can go a long way in keeping users on your platform.

Responsibilities of SaaS Companies

Recognize that when you're monetizing payments, you're no longer just a software company. You take on added responsibilities like:

managing disputes

handling refunds

ensuring secure data handling

With that in mind, proactively setting up customer support for payment-related queries and educating clients on using the new payment features is vital.

Ultimately, owning the payment experience end-to-end strengthens customer trust and positions your platform as an indispensable part of their business operations.

Metrics to Track Payment Monetization Success

Revenue from Payments

Track the total revenue generated from transaction fees, premium payment features, and bundled services. This metric provides a clear view of how payments contribute to your overall growth. Regularly monitor revenue trends to identify opportunities for upselling or optimizing pricing models.

Customer Adoption Rates

Measure how many of your customers are actively using embedded payment features. High adoption rates signal that the payment experience is seamless and valuable.

On the other hand, low adoption could indicate friction during onboarding or a lack of awareness. If users aren't getting on board, you may need to invest in better education and stronger marketing efforts.

Churn Reduction

Monitor churn rates among customers using embedded payments versus those who don't. Embedded payments often increase platform stickiness, reducing the likelihood of customer attrition. If churn decreases after implementing payments, it's a strong indicator that your monetization efforts are enhancing customer retention.

Average Revenue per User (ARPU)

Calculate the additional revenue earned from payment services per active user. A rising ARPU demonstrates that payment monetization is driving incremental growth. To make this step easier, segment users by tiers or industries and understand which groups contribute most to payment revenue, and tailor strategies accordingly.

Final Words

Monetizing payments is more than just an additional revenue stream—it's a strategic move that strengthens customer loyalty, enhances user experience, and positions your SaaS platform as an all-in-one solution. By embedding payments directly into your product, you unlock scalable growth opportunities and drive long-term profitability.

If you're monetizing payments, see to it that merchant data is secure and compliant with industry standards. Preczn lets you manage multiple fintech connections—including payment processors and lending providers.

We make it easy to enable new offerings and payment monetization initiatives without disrupting your existing workflows. Visit Preczn to explore how embedded payments can transform your SaaS platform today.

FAQs About Payment Monetization

What is SaaS Payments Monetization?

SaaS payment monetization is the practice of generating revenue from the payments processed through a software platform. This can include charging transaction fees, offering premium payment features, or bundling payment processing into subscription plans.

Why should SaaS businesses consider payment monetization?

Monetizing payments unlock new revenue streams, enhances customer experience, and increases retention by embedding critical payment features directly into the platform. It ultimately creates a more comprehensive and valuable solution.

What are the common SaaS payment monetization methods?

Common methods include charging per-transaction fees, bundling payment processing into subscription plans, offering advanced payment features for a premium, and charging for the use of non-integrated payment providers.

What is payment enrollment?

Payment enrollment is the process of signing up customers to use embedded payment services directly through the SaaS platform, streamlining the onboarding process and minimizing friction.

How can a SaaS company implement payment enrollment?

SaaS companies can implement payment enrollment by integrating opt-in options during account setup, auto-filling business details, and providing guided walkthroughs to ensure seamless adoption.

Payment monetization is increasingly becoming a "must" for SaaS companies, enabling you to unlock new revenue streams, boost customer retention, and stay competitive overall.

With the right infrastructure, you can transform payments from a back-end necessity into a core profit driver.

With businesses increasingly seeking seamless, all-in-one solutions, SaaS platforms that monetize payments are in the perfect position to deliver enhanced value while increasing their own bottom line.

Ready to do just that? Read on for the complete guide on how to monetize payments.

What is payment monetization?

Payment monetization refers to the process of generating revenue from the payment transactions that flow through a platform. Instead of simply facilitating payments as a pass-through, SaaS companies can add margin to transactions, charge for advanced payment features, or bundle payments into their core offerings to drive additional income.

SaaS companies that are able to monetize payments transform their platforms into indispensable business tools. When you implement payment monetization, you provide more value to users, all while creating scalable, recurring revenue streams.

Benefits of Payment Monetization

Unlock Additional Revenue Streams

Payment monetization allows SaaS companies to earn a percentage of each transaction processed through their platform. When you embed payment processing directly into the user experience, you can generate incremental revenue without needing to upsell or expand your core software offerings.

This model typically scales alongside your business' growth, which then creates a compounding effect that drives sustainable, long-term profits.

Enhance the User Experience

Integrated payment solutions simplify operations for your customers. How? It reduces the need for third-party providers and streamlines the payment process so customers have a more seamless experience. Your users would appreciate having a unified solution that handles both their software and financial transactions, which means they're more likely to stick with you over the long term.

Increase Customer Retention

When payments are embedded within your platform, customers rely more on your service for critical business operations. This deep integration makes it harder for them to switch providers, improving retention rates and reducing churn. The stickiness of embedded payments often translates to higher lifetime value (LTV) and greater customer satisfaction.

Models of Payment Monetization

Model | Description | Benefits |

Monetizing Transactions | Capture a percentage of each payment processed through your platform. This scales with customer growth. | Scalable revenue aligned with transaction volume growth. Easy to implement and track. |

Bundling Payments into Existing Plans | Include payment processing in subscription plans, offering an all-in-one pricing model. | Simplifies pricing, reduces customer decision fatigue, and ensures predictable recurring revenue. |

Charging for Advanced Payment Features | Offer premium services (e.g., faster payouts, advanced reporting) at an additional cost. | Tiered monetization unlocks new revenue while keeping basic services affordable. |

Charging for Non-Embedded Payment Providers | Apply fees or surcharges to customers using third-party or non-integrated payment providers. | Incentivizes adoption of embedded payments, increases revenue, and reinforces value by highlighting cost savings. |

Payment monetization comes in different forms. Depending on your platform and business model, you can opt for one or a combination of methods to drive additional revenue from the payments you process.

Monetizing Transactions

A per-transaction fee model allows SaaS companies to take a cut out of every transaction processed on the platform. This model aligns with customer growth—meaning as their sales volume increases, so does your revenue. Transaction fees are easy to implement and offer a clear, scalable path to payment monetization.

Bundling Payments into Existing Plans

Consider adding payment processing as part of your current subscription plans. Doing so creates a streamlined offering that reduces decision fatigue for customers. This model allows SaaS companies to bake the cost of payments into monthly or annual pricing, presenting it as an all-inclusive solution. It simplifies pricing while also creating predictable, recurring revenue for your business.

Charging for Advanced Payment Features

Offering premium payment features—e.g., faster payouts, enhanced reporting, or advanced fraud protection—creates opportunities to charge additional fees. This tiered approach lets you monetize payment functionality without impacting basic services. Customers can upgrade as their needs evolve, unlocking new revenue streams over time.

Charging Merchants for Using a Non-Embedded or Integrated Payments Provider

One way to encourage customers to adopt your embedded payment solution is by charging a higher fee or adding surcharges for those who choose external payment providers. This gives people a clear reason to choose your payment solutions over other providers. Just note that people generally don't like being forced to adopt vendors, so you'll need to be careful when implementing this approach.

Steps to Monetize Payments

Whether you're charging a per-transaction fee, using a subscription model, charging add-on services—or all of the above—the steps for how to monetize payments generally include the following.

Assess Your Platform's Payment Volume and Potential

Start by analyzing your current transaction flow to understand where and how payments are processed. Look for areas where embedded payments could simplify customer workflows. How can you provide immediate value through payment functionalities?

Take, for example, a SaaS platform that serves fitness studios. The platform handles class bookings, but the company noticed that many of its users (fitness studios) still manually invoice for personal training sessions or retail sales.

With that in mind, the SaaS company decides to embed a seamless point-of-sale system and recurring payments for memberships into its platform. Doing so not only simplifies operations for its clients but also captures a percentage of every transaction. Plus, it reduces reliance on external payment gateways and creates a new revenue stream tied directly to customer success.

Implement this same exercise in your business by conducting a payment audit across your customer journey. Identify areas where there's manual work or involve third-party payment providers, and devise solutions to simplify their experience.

Choose the Right Payment Partner

When it comes to fintech monetization, the right payment processor will make all the difference. Choose a provider that aligns with your growth goals, offers competitive rates, and provides the flexibility to scale.

You should also prioritize partners that offer seamless API integrations and customizable payment flows to ensure your solution fits nicely into your platform.

Another key feature is white-label capabilities for maintaining brand consistency.

Some of the steps you can take to find the provider include:

Research payment processors with experience in your industry

Request demos to evaluate API functionality

Look for scalable pricing models

Ensure compliance and security certifications

Check customer reviews and case studies

Assess customer support availability

Evaluate customization options for branded experiences

In some cases, you may need to partner with multiple payment providers or transfer merchant data from one platform to another. Preczn can help streamline the payment orchestration process by bringing together all your fintech customers, providers, services, and data.

What’s more, Preczn allows you to vault your merchants and payment data in order to prevent vendor lock-in and make payment data migration easier.

Implement Payment Enrollment

Make it easy for customers to enroll in your payment services directly through your platform. Automate onboarding processes and minimize friction by integrating payment enrollment during account setup or checkout. The faster users adopt your payment solution, the quicker you can drive revenue and increase stickiness.

Here's an example of what a good payment enrollment process can look like:

Simple opt-in during account creation

Auto-fill business details from existing data

One-click verification for account linking

Immediate confirmation emails

Guided onboarding walkthroughs

Set Up Pricing Models

The right pricing model depends on your platform and offerings. You should consider transaction fees, bundled pricing, or tiered payment features. The key is to find the right balance between revenue generation and perceived customer value.

Also, remember that transparency in pricing helps build trust and encourages adoption, so provide clear breakdowns of fees during onboarding and on pricing pages.

Build and Market Payment Features to Customers

Communicate the value of your payment solutions through targeted marketing and in-app messaging. Highlight the convenience, cost savings, and efficiency of using embedded payments.

That way, customers can easily access information about the benefits, see pricing options, and sign up or request a demo directly.

A great example of this comes from Mindbody's payments landing page. The page highlights how embedded payments reduce administrative tasks by automating billing and streamlining checkout experiences. It has a breakdown of features like point-of-sale tools and mobile payment options and emphasizes how faster transactions can improve cash flow.

Other ways to market your payment capabilities include webinars, guides, and demos to educate customers about new features and drive adoption.

Monitor and Optimize for Profitability and User Adoption

Track essential payment performance metrics. These can include:

adoption rates

transaction volumes

revenue growth.

Having these metrics in your back pocket lets you refine your payment monetization strategy over time.

Additionally, strive to optimize user experience, address pain points, and roll out feature enhancements that add value. When you do this consistently, you can sustain long-term profitability and engagement.

Key Considerations Before Monetizing Payments

Compliance and Regulatory Factors

Offering payment services comes with a lot of responsibilities. For starters, you must ensure compliance with PCI DSS standards, anti-money laundering (AML) laws, and local financial regulations. Partnering with a payment processor with built-in compliance features can help with this.

In addition, staying informed about evolving regulations helps mitigate risks and protects both your platform and your customers from potential fines or disruptions.

Technical Infrastructure and Integration Needs

Assess your platform's technical capacity to handle embedded payment flows. Seamless API integration, scalability, and data security are crucial. For best results, collaborate with your development team to ensure your platform can support real-time transactions and complex payment features. Prioritize a payment partner with robust developer documentation and support to minimize friction during integration and ensure long-term reliability.

Customer Experience

Embedded payments should enhance—not complicate—the customer experience. That's why you should create a frictionless, intuitive payment process that integrates seamlessly with your platform's existing workflows.

Also, consider additional features that can boost customer satisfaction and adoption rates. Things like flexible payment methods, one-click checkout, and transparent pricing can go a long way in keeping users on your platform.

Responsibilities of SaaS Companies

Recognize that when you're monetizing payments, you're no longer just a software company. You take on added responsibilities like:

managing disputes

handling refunds

ensuring secure data handling

With that in mind, proactively setting up customer support for payment-related queries and educating clients on using the new payment features is vital.

Ultimately, owning the payment experience end-to-end strengthens customer trust and positions your platform as an indispensable part of their business operations.

Metrics to Track Payment Monetization Success

Revenue from Payments

Track the total revenue generated from transaction fees, premium payment features, and bundled services. This metric provides a clear view of how payments contribute to your overall growth. Regularly monitor revenue trends to identify opportunities for upselling or optimizing pricing models.

Customer Adoption Rates

Measure how many of your customers are actively using embedded payment features. High adoption rates signal that the payment experience is seamless and valuable.

On the other hand, low adoption could indicate friction during onboarding or a lack of awareness. If users aren't getting on board, you may need to invest in better education and stronger marketing efforts.

Churn Reduction

Monitor churn rates among customers using embedded payments versus those who don't. Embedded payments often increase platform stickiness, reducing the likelihood of customer attrition. If churn decreases after implementing payments, it's a strong indicator that your monetization efforts are enhancing customer retention.

Average Revenue per User (ARPU)

Calculate the additional revenue earned from payment services per active user. A rising ARPU demonstrates that payment monetization is driving incremental growth. To make this step easier, segment users by tiers or industries and understand which groups contribute most to payment revenue, and tailor strategies accordingly.

Final Words

Monetizing payments is more than just an additional revenue stream—it's a strategic move that strengthens customer loyalty, enhances user experience, and positions your SaaS platform as an all-in-one solution. By embedding payments directly into your product, you unlock scalable growth opportunities and drive long-term profitability.

If you're monetizing payments, see to it that merchant data is secure and compliant with industry standards. Preczn lets you manage multiple fintech connections—including payment processors and lending providers.

We make it easy to enable new offerings and payment monetization initiatives without disrupting your existing workflows. Visit Preczn to explore how embedded payments can transform your SaaS platform today.

FAQs About Payment Monetization

What is SaaS Payments Monetization?

SaaS payment monetization is the practice of generating revenue from the payments processed through a software platform. This can include charging transaction fees, offering premium payment features, or bundling payment processing into subscription plans.

Why should SaaS businesses consider payment monetization?

Monetizing payments unlock new revenue streams, enhances customer experience, and increases retention by embedding critical payment features directly into the platform. It ultimately creates a more comprehensive and valuable solution.

What are the common SaaS payment monetization methods?

Common methods include charging per-transaction fees, bundling payment processing into subscription plans, offering advanced payment features for a premium, and charging for the use of non-integrated payment providers.

What is payment enrollment?

Payment enrollment is the process of signing up customers to use embedded payment services directly through the SaaS platform, streamlining the onboarding process and minimizing friction.

How can a SaaS company implement payment enrollment?

SaaS companies can implement payment enrollment by integrating opt-in options during account setup, auto-filling business details, and providing guided walkthroughs to ensure seamless adoption.

Payment monetization is increasingly becoming a "must" for SaaS companies, enabling you to unlock new revenue streams, boost customer retention, and stay competitive overall.

With the right infrastructure, you can transform payments from a back-end necessity into a core profit driver.

With businesses increasingly seeking seamless, all-in-one solutions, SaaS platforms that monetize payments are in the perfect position to deliver enhanced value while increasing their own bottom line.

Ready to do just that? Read on for the complete guide on how to monetize payments.

What is payment monetization?

Payment monetization refers to the process of generating revenue from the payment transactions that flow through a platform. Instead of simply facilitating payments as a pass-through, SaaS companies can add margin to transactions, charge for advanced payment features, or bundle payments into their core offerings to drive additional income.

SaaS companies that are able to monetize payments transform their platforms into indispensable business tools. When you implement payment monetization, you provide more value to users, all while creating scalable, recurring revenue streams.

Benefits of Payment Monetization

Unlock Additional Revenue Streams

Payment monetization allows SaaS companies to earn a percentage of each transaction processed through their platform. When you embed payment processing directly into the user experience, you can generate incremental revenue without needing to upsell or expand your core software offerings.

This model typically scales alongside your business' growth, which then creates a compounding effect that drives sustainable, long-term profits.

Enhance the User Experience

Integrated payment solutions simplify operations for your customers. How? It reduces the need for third-party providers and streamlines the payment process so customers have a more seamless experience. Your users would appreciate having a unified solution that handles both their software and financial transactions, which means they're more likely to stick with you over the long term.

Increase Customer Retention

When payments are embedded within your platform, customers rely more on your service for critical business operations. This deep integration makes it harder for them to switch providers, improving retention rates and reducing churn. The stickiness of embedded payments often translates to higher lifetime value (LTV) and greater customer satisfaction.

Models of Payment Monetization

Model | Description | Benefits |

Monetizing Transactions | Capture a percentage of each payment processed through your platform. This scales with customer growth. | Scalable revenue aligned with transaction volume growth. Easy to implement and track. |

Bundling Payments into Existing Plans | Include payment processing in subscription plans, offering an all-in-one pricing model. | Simplifies pricing, reduces customer decision fatigue, and ensures predictable recurring revenue. |

Charging for Advanced Payment Features | Offer premium services (e.g., faster payouts, advanced reporting) at an additional cost. | Tiered monetization unlocks new revenue while keeping basic services affordable. |

Charging for Non-Embedded Payment Providers | Apply fees or surcharges to customers using third-party or non-integrated payment providers. | Incentivizes adoption of embedded payments, increases revenue, and reinforces value by highlighting cost savings. |

Payment monetization comes in different forms. Depending on your platform and business model, you can opt for one or a combination of methods to drive additional revenue from the payments you process.

Monetizing Transactions

A per-transaction fee model allows SaaS companies to take a cut out of every transaction processed on the platform. This model aligns with customer growth—meaning as their sales volume increases, so does your revenue. Transaction fees are easy to implement and offer a clear, scalable path to payment monetization.

Bundling Payments into Existing Plans

Consider adding payment processing as part of your current subscription plans. Doing so creates a streamlined offering that reduces decision fatigue for customers. This model allows SaaS companies to bake the cost of payments into monthly or annual pricing, presenting it as an all-inclusive solution. It simplifies pricing while also creating predictable, recurring revenue for your business.

Charging for Advanced Payment Features

Offering premium payment features—e.g., faster payouts, enhanced reporting, or advanced fraud protection—creates opportunities to charge additional fees. This tiered approach lets you monetize payment functionality without impacting basic services. Customers can upgrade as their needs evolve, unlocking new revenue streams over time.

Charging Merchants for Using a Non-Embedded or Integrated Payments Provider

One way to encourage customers to adopt your embedded payment solution is by charging a higher fee or adding surcharges for those who choose external payment providers. This gives people a clear reason to choose your payment solutions over other providers. Just note that people generally don't like being forced to adopt vendors, so you'll need to be careful when implementing this approach.

Steps to Monetize Payments

Whether you're charging a per-transaction fee, using a subscription model, charging add-on services—or all of the above—the steps for how to monetize payments generally include the following.

Assess Your Platform's Payment Volume and Potential

Start by analyzing your current transaction flow to understand where and how payments are processed. Look for areas where embedded payments could simplify customer workflows. How can you provide immediate value through payment functionalities?

Take, for example, a SaaS platform that serves fitness studios. The platform handles class bookings, but the company noticed that many of its users (fitness studios) still manually invoice for personal training sessions or retail sales.

With that in mind, the SaaS company decides to embed a seamless point-of-sale system and recurring payments for memberships into its platform. Doing so not only simplifies operations for its clients but also captures a percentage of every transaction. Plus, it reduces reliance on external payment gateways and creates a new revenue stream tied directly to customer success.

Implement this same exercise in your business by conducting a payment audit across your customer journey. Identify areas where there's manual work or involve third-party payment providers, and devise solutions to simplify their experience.

Choose the Right Payment Partner

When it comes to fintech monetization, the right payment processor will make all the difference. Choose a provider that aligns with your growth goals, offers competitive rates, and provides the flexibility to scale.

You should also prioritize partners that offer seamless API integrations and customizable payment flows to ensure your solution fits nicely into your platform.

Another key feature is white-label capabilities for maintaining brand consistency.

Some of the steps you can take to find the provider include:

Research payment processors with experience in your industry

Request demos to evaluate API functionality

Look for scalable pricing models

Ensure compliance and security certifications

Check customer reviews and case studies

Assess customer support availability

Evaluate customization options for branded experiences

In some cases, you may need to partner with multiple payment providers or transfer merchant data from one platform to another. Preczn can help streamline the payment orchestration process by bringing together all your fintech customers, providers, services, and data.

What’s more, Preczn allows you to vault your merchants and payment data in order to prevent vendor lock-in and make payment data migration easier.

Implement Payment Enrollment

Make it easy for customers to enroll in your payment services directly through your platform. Automate onboarding processes and minimize friction by integrating payment enrollment during account setup or checkout. The faster users adopt your payment solution, the quicker you can drive revenue and increase stickiness.

Here's an example of what a good payment enrollment process can look like:

Simple opt-in during account creation

Auto-fill business details from existing data

One-click verification for account linking

Immediate confirmation emails

Guided onboarding walkthroughs

Set Up Pricing Models

The right pricing model depends on your platform and offerings. You should consider transaction fees, bundled pricing, or tiered payment features. The key is to find the right balance between revenue generation and perceived customer value.

Also, remember that transparency in pricing helps build trust and encourages adoption, so provide clear breakdowns of fees during onboarding and on pricing pages.

Build and Market Payment Features to Customers

Communicate the value of your payment solutions through targeted marketing and in-app messaging. Highlight the convenience, cost savings, and efficiency of using embedded payments.

That way, customers can easily access information about the benefits, see pricing options, and sign up or request a demo directly.

A great example of this comes from Mindbody's payments landing page. The page highlights how embedded payments reduce administrative tasks by automating billing and streamlining checkout experiences. It has a breakdown of features like point-of-sale tools and mobile payment options and emphasizes how faster transactions can improve cash flow.

Other ways to market your payment capabilities include webinars, guides, and demos to educate customers about new features and drive adoption.

Monitor and Optimize for Profitability and User Adoption

Track essential payment performance metrics. These can include:

adoption rates

transaction volumes

revenue growth.

Having these metrics in your back pocket lets you refine your payment monetization strategy over time.

Additionally, strive to optimize user experience, address pain points, and roll out feature enhancements that add value. When you do this consistently, you can sustain long-term profitability and engagement.

Key Considerations Before Monetizing Payments

Compliance and Regulatory Factors

Offering payment services comes with a lot of responsibilities. For starters, you must ensure compliance with PCI DSS standards, anti-money laundering (AML) laws, and local financial regulations. Partnering with a payment processor with built-in compliance features can help with this.

In addition, staying informed about evolving regulations helps mitigate risks and protects both your platform and your customers from potential fines or disruptions.

Technical Infrastructure and Integration Needs

Assess your platform's technical capacity to handle embedded payment flows. Seamless API integration, scalability, and data security are crucial. For best results, collaborate with your development team to ensure your platform can support real-time transactions and complex payment features. Prioritize a payment partner with robust developer documentation and support to minimize friction during integration and ensure long-term reliability.

Customer Experience

Embedded payments should enhance—not complicate—the customer experience. That's why you should create a frictionless, intuitive payment process that integrates seamlessly with your platform's existing workflows.

Also, consider additional features that can boost customer satisfaction and adoption rates. Things like flexible payment methods, one-click checkout, and transparent pricing can go a long way in keeping users on your platform.

Responsibilities of SaaS Companies

Recognize that when you're monetizing payments, you're no longer just a software company. You take on added responsibilities like:

managing disputes

handling refunds

ensuring secure data handling

With that in mind, proactively setting up customer support for payment-related queries and educating clients on using the new payment features is vital.

Ultimately, owning the payment experience end-to-end strengthens customer trust and positions your platform as an indispensable part of their business operations.

Metrics to Track Payment Monetization Success

Revenue from Payments

Track the total revenue generated from transaction fees, premium payment features, and bundled services. This metric provides a clear view of how payments contribute to your overall growth. Regularly monitor revenue trends to identify opportunities for upselling or optimizing pricing models.

Customer Adoption Rates

Measure how many of your customers are actively using embedded payment features. High adoption rates signal that the payment experience is seamless and valuable.

On the other hand, low adoption could indicate friction during onboarding or a lack of awareness. If users aren't getting on board, you may need to invest in better education and stronger marketing efforts.

Churn Reduction

Monitor churn rates among customers using embedded payments versus those who don't. Embedded payments often increase platform stickiness, reducing the likelihood of customer attrition. If churn decreases after implementing payments, it's a strong indicator that your monetization efforts are enhancing customer retention.

Average Revenue per User (ARPU)

Calculate the additional revenue earned from payment services per active user. A rising ARPU demonstrates that payment monetization is driving incremental growth. To make this step easier, segment users by tiers or industries and understand which groups contribute most to payment revenue, and tailor strategies accordingly.

Final Words

Monetizing payments is more than just an additional revenue stream—it's a strategic move that strengthens customer loyalty, enhances user experience, and positions your SaaS platform as an all-in-one solution. By embedding payments directly into your product, you unlock scalable growth opportunities and drive long-term profitability.

If you're monetizing payments, see to it that merchant data is secure and compliant with industry standards. Preczn lets you manage multiple fintech connections—including payment processors and lending providers.

We make it easy to enable new offerings and payment monetization initiatives without disrupting your existing workflows. Visit Preczn to explore how embedded payments can transform your SaaS platform today.

FAQs About Payment Monetization

What is SaaS Payments Monetization?

SaaS payment monetization is the practice of generating revenue from the payments processed through a software platform. This can include charging transaction fees, offering premium payment features, or bundling payment processing into subscription plans.

Why should SaaS businesses consider payment monetization?

Monetizing payments unlock new revenue streams, enhances customer experience, and increases retention by embedding critical payment features directly into the platform. It ultimately creates a more comprehensive and valuable solution.

What are the common SaaS payment monetization methods?

Common methods include charging per-transaction fees, bundling payment processing into subscription plans, offering advanced payment features for a premium, and charging for the use of non-integrated payment providers.

What is payment enrollment?

Payment enrollment is the process of signing up customers to use embedded payment services directly through the SaaS platform, streamlining the onboarding process and minimizing friction.

How can a SaaS company implement payment enrollment?

SaaS companies can implement payment enrollment by integrating opt-in options during account setup, auto-filling business details, and providing guided walkthroughs to ensure seamless adoption.

Payment monetization is increasingly becoming a "must" for SaaS companies, enabling you to unlock new revenue streams, boost customer retention, and stay competitive overall.

With the right infrastructure, you can transform payments from a back-end necessity into a core profit driver.

With businesses increasingly seeking seamless, all-in-one solutions, SaaS platforms that monetize payments are in the perfect position to deliver enhanced value while increasing their own bottom line.

Ready to do just that? Read on for the complete guide on how to monetize payments.

What is payment monetization?

Payment monetization refers to the process of generating revenue from the payment transactions that flow through a platform. Instead of simply facilitating payments as a pass-through, SaaS companies can add margin to transactions, charge for advanced payment features, or bundle payments into their core offerings to drive additional income.

SaaS companies that are able to monetize payments transform their platforms into indispensable business tools. When you implement payment monetization, you provide more value to users, all while creating scalable, recurring revenue streams.

Benefits of Payment Monetization

Unlock Additional Revenue Streams

Payment monetization allows SaaS companies to earn a percentage of each transaction processed through their platform. When you embed payment processing directly into the user experience, you can generate incremental revenue without needing to upsell or expand your core software offerings.

This model typically scales alongside your business' growth, which then creates a compounding effect that drives sustainable, long-term profits.

Enhance the User Experience

Integrated payment solutions simplify operations for your customers. How? It reduces the need for third-party providers and streamlines the payment process so customers have a more seamless experience. Your users would appreciate having a unified solution that handles both their software and financial transactions, which means they're more likely to stick with you over the long term.

Increase Customer Retention

When payments are embedded within your platform, customers rely more on your service for critical business operations. This deep integration makes it harder for them to switch providers, improving retention rates and reducing churn. The stickiness of embedded payments often translates to higher lifetime value (LTV) and greater customer satisfaction.

Models of Payment Monetization

Model | Description | Benefits |

Monetizing Transactions | Capture a percentage of each payment processed through your platform. This scales with customer growth. | Scalable revenue aligned with transaction volume growth. Easy to implement and track. |

Bundling Payments into Existing Plans | Include payment processing in subscription plans, offering an all-in-one pricing model. | Simplifies pricing, reduces customer decision fatigue, and ensures predictable recurring revenue. |

Charging for Advanced Payment Features | Offer premium services (e.g., faster payouts, advanced reporting) at an additional cost. | Tiered monetization unlocks new revenue while keeping basic services affordable. |

Charging for Non-Embedded Payment Providers | Apply fees or surcharges to customers using third-party or non-integrated payment providers. | Incentivizes adoption of embedded payments, increases revenue, and reinforces value by highlighting cost savings. |

Payment monetization comes in different forms. Depending on your platform and business model, you can opt for one or a combination of methods to drive additional revenue from the payments you process.

Monetizing Transactions

A per-transaction fee model allows SaaS companies to take a cut out of every transaction processed on the platform. This model aligns with customer growth—meaning as their sales volume increases, so does your revenue. Transaction fees are easy to implement and offer a clear, scalable path to payment monetization.

Bundling Payments into Existing Plans

Consider adding payment processing as part of your current subscription plans. Doing so creates a streamlined offering that reduces decision fatigue for customers. This model allows SaaS companies to bake the cost of payments into monthly or annual pricing, presenting it as an all-inclusive solution. It simplifies pricing while also creating predictable, recurring revenue for your business.

Charging for Advanced Payment Features

Offering premium payment features—e.g., faster payouts, enhanced reporting, or advanced fraud protection—creates opportunities to charge additional fees. This tiered approach lets you monetize payment functionality without impacting basic services. Customers can upgrade as their needs evolve, unlocking new revenue streams over time.

Charging Merchants for Using a Non-Embedded or Integrated Payments Provider

One way to encourage customers to adopt your embedded payment solution is by charging a higher fee or adding surcharges for those who choose external payment providers. This gives people a clear reason to choose your payment solutions over other providers. Just note that people generally don't like being forced to adopt vendors, so you'll need to be careful when implementing this approach.

Steps to Monetize Payments

Whether you're charging a per-transaction fee, using a subscription model, charging add-on services—or all of the above—the steps for how to monetize payments generally include the following.

Assess Your Platform's Payment Volume and Potential

Start by analyzing your current transaction flow to understand where and how payments are processed. Look for areas where embedded payments could simplify customer workflows. How can you provide immediate value through payment functionalities?

Take, for example, a SaaS platform that serves fitness studios. The platform handles class bookings, but the company noticed that many of its users (fitness studios) still manually invoice for personal training sessions or retail sales.

With that in mind, the SaaS company decides to embed a seamless point-of-sale system and recurring payments for memberships into its platform. Doing so not only simplifies operations for its clients but also captures a percentage of every transaction. Plus, it reduces reliance on external payment gateways and creates a new revenue stream tied directly to customer success.

Implement this same exercise in your business by conducting a payment audit across your customer journey. Identify areas where there's manual work or involve third-party payment providers, and devise solutions to simplify their experience.

Choose the Right Payment Partner

When it comes to fintech monetization, the right payment processor will make all the difference. Choose a provider that aligns with your growth goals, offers competitive rates, and provides the flexibility to scale.

You should also prioritize partners that offer seamless API integrations and customizable payment flows to ensure your solution fits nicely into your platform.

Another key feature is white-label capabilities for maintaining brand consistency.

Some of the steps you can take to find the provider include:

Research payment processors with experience in your industry

Request demos to evaluate API functionality

Look for scalable pricing models

Ensure compliance and security certifications

Check customer reviews and case studies

Assess customer support availability

Evaluate customization options for branded experiences

In some cases, you may need to partner with multiple payment providers or transfer merchant data from one platform to another. Preczn can help streamline the payment orchestration process by bringing together all your fintech customers, providers, services, and data.

What’s more, Preczn allows you to vault your merchants and payment data in order to prevent vendor lock-in and make payment data migration easier.

Implement Payment Enrollment

Make it easy for customers to enroll in your payment services directly through your platform. Automate onboarding processes and minimize friction by integrating payment enrollment during account setup or checkout. The faster users adopt your payment solution, the quicker you can drive revenue and increase stickiness.

Here's an example of what a good payment enrollment process can look like:

Simple opt-in during account creation

Auto-fill business details from existing data

One-click verification for account linking

Immediate confirmation emails

Guided onboarding walkthroughs

Set Up Pricing Models

The right pricing model depends on your platform and offerings. You should consider transaction fees, bundled pricing, or tiered payment features. The key is to find the right balance between revenue generation and perceived customer value.

Also, remember that transparency in pricing helps build trust and encourages adoption, so provide clear breakdowns of fees during onboarding and on pricing pages.

Build and Market Payment Features to Customers

Communicate the value of your payment solutions through targeted marketing and in-app messaging. Highlight the convenience, cost savings, and efficiency of using embedded payments.

That way, customers can easily access information about the benefits, see pricing options, and sign up or request a demo directly.

A great example of this comes from Mindbody's payments landing page. The page highlights how embedded payments reduce administrative tasks by automating billing and streamlining checkout experiences. It has a breakdown of features like point-of-sale tools and mobile payment options and emphasizes how faster transactions can improve cash flow.

Other ways to market your payment capabilities include webinars, guides, and demos to educate customers about new features and drive adoption.

Monitor and Optimize for Profitability and User Adoption

Track essential payment performance metrics. These can include:

adoption rates

transaction volumes

revenue growth.

Having these metrics in your back pocket lets you refine your payment monetization strategy over time.

Additionally, strive to optimize user experience, address pain points, and roll out feature enhancements that add value. When you do this consistently, you can sustain long-term profitability and engagement.

Key Considerations Before Monetizing Payments

Compliance and Regulatory Factors

Offering payment services comes with a lot of responsibilities. For starters, you must ensure compliance with PCI DSS standards, anti-money laundering (AML) laws, and local financial regulations. Partnering with a payment processor with built-in compliance features can help with this.

In addition, staying informed about evolving regulations helps mitigate risks and protects both your platform and your customers from potential fines or disruptions.

Technical Infrastructure and Integration Needs

Assess your platform's technical capacity to handle embedded payment flows. Seamless API integration, scalability, and data security are crucial. For best results, collaborate with your development team to ensure your platform can support real-time transactions and complex payment features. Prioritize a payment partner with robust developer documentation and support to minimize friction during integration and ensure long-term reliability.

Customer Experience

Embedded payments should enhance—not complicate—the customer experience. That's why you should create a frictionless, intuitive payment process that integrates seamlessly with your platform's existing workflows.

Also, consider additional features that can boost customer satisfaction and adoption rates. Things like flexible payment methods, one-click checkout, and transparent pricing can go a long way in keeping users on your platform.

Responsibilities of SaaS Companies

Recognize that when you're monetizing payments, you're no longer just a software company. You take on added responsibilities like:

managing disputes

handling refunds

ensuring secure data handling

With that in mind, proactively setting up customer support for payment-related queries and educating clients on using the new payment features is vital.

Ultimately, owning the payment experience end-to-end strengthens customer trust and positions your platform as an indispensable part of their business operations.

Metrics to Track Payment Monetization Success

Revenue from Payments

Track the total revenue generated from transaction fees, premium payment features, and bundled services. This metric provides a clear view of how payments contribute to your overall growth. Regularly monitor revenue trends to identify opportunities for upselling or optimizing pricing models.

Customer Adoption Rates

Measure how many of your customers are actively using embedded payment features. High adoption rates signal that the payment experience is seamless and valuable.

On the other hand, low adoption could indicate friction during onboarding or a lack of awareness. If users aren't getting on board, you may need to invest in better education and stronger marketing efforts.

Churn Reduction

Monitor churn rates among customers using embedded payments versus those who don't. Embedded payments often increase platform stickiness, reducing the likelihood of customer attrition. If churn decreases after implementing payments, it's a strong indicator that your monetization efforts are enhancing customer retention.

Average Revenue per User (ARPU)

Calculate the additional revenue earned from payment services per active user. A rising ARPU demonstrates that payment monetization is driving incremental growth. To make this step easier, segment users by tiers or industries and understand which groups contribute most to payment revenue, and tailor strategies accordingly.

Final Words

Monetizing payments is more than just an additional revenue stream—it's a strategic move that strengthens customer loyalty, enhances user experience, and positions your SaaS platform as an all-in-one solution. By embedding payments directly into your product, you unlock scalable growth opportunities and drive long-term profitability.

If you're monetizing payments, see to it that merchant data is secure and compliant with industry standards. Preczn lets you manage multiple fintech connections—including payment processors and lending providers.

We make it easy to enable new offerings and payment monetization initiatives without disrupting your existing workflows. Visit Preczn to explore how embedded payments can transform your SaaS platform today.

FAQs About Payment Monetization

What is SaaS Payments Monetization?

SaaS payment monetization is the practice of generating revenue from the payments processed through a software platform. This can include charging transaction fees, offering premium payment features, or bundling payment processing into subscription plans.

Why should SaaS businesses consider payment monetization?

Monetizing payments unlock new revenue streams, enhances customer experience, and increases retention by embedding critical payment features directly into the platform. It ultimately creates a more comprehensive and valuable solution.

What are the common SaaS payment monetization methods?

Common methods include charging per-transaction fees, bundling payment processing into subscription plans, offering advanced payment features for a premium, and charging for the use of non-integrated payment providers.

What is payment enrollment?

Payment enrollment is the process of signing up customers to use embedded payment services directly through the SaaS platform, streamlining the onboarding process and minimizing friction.

How can a SaaS company implement payment enrollment?

SaaS companies can implement payment enrollment by integrating opt-in options during account setup, auto-filling business details, and providing guided walkthroughs to ensure seamless adoption.